gesrey/iStock via Getty Images

Cryptocurrency brokerage Genesis’ lending desk experienced a “wave of year-end deleveraging” as digital asset prices continue to fall in a nearly three-month cyclical decline, according to the company’s fourth-quarter results. Increased regulatory scrutiny on digital assets, as well as broader price volatility in a broader risk-off environment, have pushed down crypto prices to multi-month lows.

Loans outstanding peaked at more than $16B in mid-November – about the same time that the global crypto market cap topped out at $3T. Bitcoin (BTC-USD) and ethereum (ETH-USD), which account for the majority of the crypto market cap, climaxed at about the same time as well. Meanwhile, as more institutions participate in the crypto market, Genesis, one of the largest digital asset lenders, loaned out a record $50B in Q4 2021. This figure is up 40% from the prior quarter and 565% above its Y/Y print.

- Q4 active loans outstanding of $12.5B jumped 12% from the third quarter and almost 3.3x the amount outstanding in the same period a year ago.

- Q4 spot desk trading volume rose 23% from Q3 and surged 279% from Q4 of last year.

- Q4 derivatives desk trading volume, which includes bilateral over-the-counter, negotiated block trades and exchange traded volumes, of $20.7B soars 62% from Q3 and more than 360% from Q4 2020.

- The number of customers onboarded in Q4 drove 53% from the prior quarter. Note that Genesis Custody began staking assets for clients over the course of Q4, the report said.

Digging deeper in Genesis’ lending mix, it appears much of the mix shifted toward USD (USDC-USD) stablecoin and ethereum (ETH-USD) originations, along with the return of the Soluna (SOL-USD), Terra (LUNA-USD) and Avalanche (AVAX-USD) rotation executed by crypto native institutions to capture outsized yield, according to the report. Of course, these tokens are the centerpiece of decentralized finance. Additionally, lending saw growing interest in DeFi 2.0 protocols and gaming tokens, signaling speculators’ appetite to position further out the risk spectrum.

NFT craze:

As interest in non-fungible tokens continues to grow – and even surpasses that of bitcoin (BTC-USD) – Genesis recently expanded its NFT-backed lending portfolio by “underwriting loans backed by high-quality, ‘blue-chip’ NFT collateral,” the report said. This would certainly be risky “collateral” in the event that NFTs depreciate in price.

Watch out for regulatory hurdles:

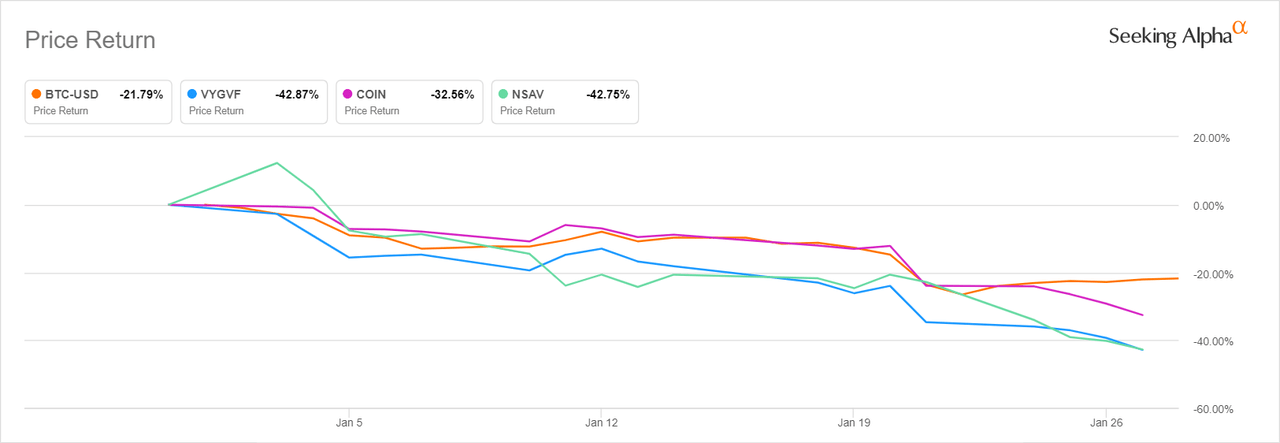

A raft of digital asset firms, such as crypto lender Celsius Network, offer competitively attractive yields of more than 6% for loans, and “with no govt regulation, this lending is as risky as a hand of blackjack,” John Hopkins Economist Steve Hanke wrote in a Twitter post in mid-December. Recall earlier this week when crypto exchange Gemini, digital asset platform Voyager Digital (OTCQX:VYGVF) and Celsius faced scrutiny from the Securities and Exchange Commission on their high-yielding product offering. Towards the end of September, Coinbase (NASDAQ:COIN) said it won’t pursue crypto lending after the SEC threatened to sue the company because the feature is considered a security. It comes at no surprise that shares of Voyager Digital, Coinbase, along with its rivals, are dropping as much as 43% YTD, as bitcoin (BTC-USD) continues to be faced with selling pressure, recently changing hands at $36.9K per token vs. its all-time highs at $69.4K from mid-November.

Earlier this week, the SEC rejected Fidelity’s spot bitcoin ETF proposal.