Chinnapong/iStock Editorial via Getty Images

Cryptocurrencies’ “rapid” growth in usage and adoption over the past couple of years poses similarities to frenzy-driven events, such as the internet craze in the mid 1990s, Wells Fargo’s global investment strategy team wrote in a report earlier this month.

The gripping asset class, “appear to be near a hyper-adoption phase, similar to that of the internet during the mid-to-late 1990s,” the note highlighted.

The world’s largest and most popular digital token by market cap, bitcoin (BTC-USD), has compounded at a 216% annual rate since its first recorded transaction in 2010 vs. just 16% compounded annually for the S&P 500 (SP500), according to the report. On the other hand, if BTC’s price return was measured on a risk-adjusted basis, using the Sharpe ratio for example, then returns would likely look less attractive due to cryptos’ high volatility (beta).

Crypto is still early in the crypto investment evolution:

Wells Fargo is not in the “too late to invest” camp because “performance numbers are skewed,” as most digital coins evolved from the zero bound. Additionally, cryptos are “still a relatively young investment space,” with the vast majority of these coins being less than five years old. Note Bitcoin (BTC-USD) is the oldest coin in the crypto ecosystem, and ethereum (ETH-USD) was released five years later.

With 3% of the world’s population using cryptos as of June 2021, Wells Fargo said the emerging asset class may have already reached an adoption inflection point based on the similar historical trend of internet usage during the dotcom era. Specifically, Wells Fargo compared the global adoption rate of the internet beginning in 1993 and crypto users beginning in 2014. And progress evolving around a regulatory framework for the digital asset market will also likely support further crypto adoption, Wells Fargo noted. To date, the digital asset market does not fall under a single regulatory regime, though agencies like the Commodity Futures Trading Commission recently requested Congress for greater oversight on the space. Take a look at Seeking Alpha contributor Vincent Ventures’ deep dive into crypto regulations.

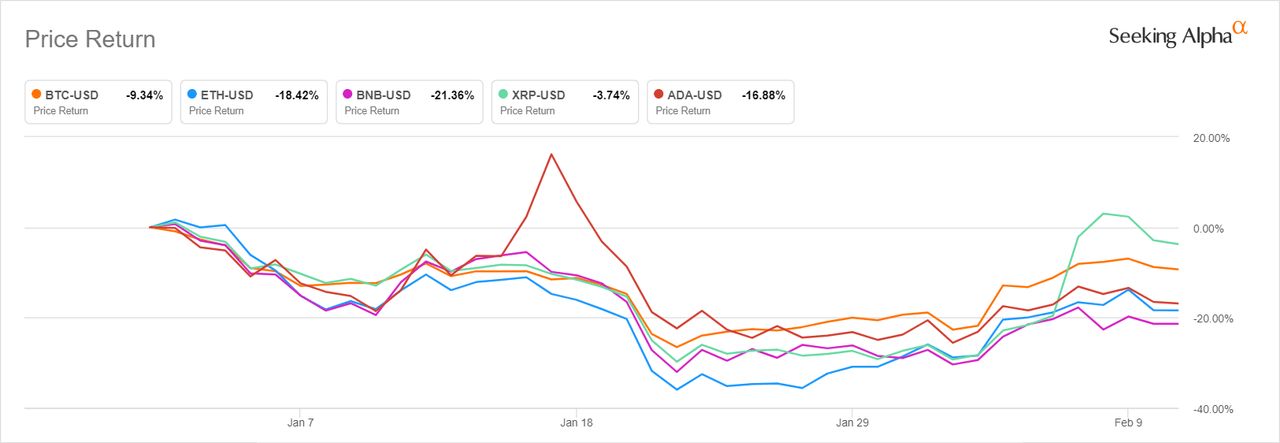

Looking at the total returns for the tope five largest digital coins on a YTD basis, the market has been faced with selling pressure amid regulatory uncertainties for the space, tighter global financial conditions and a broader risk-off environment.

Earlier in the week ended Feb. 11, J.P. Morgan estimated bitcoin’s fair value at $38K.