Cryptocurrency may have once seemed like a niche interest or a passing fad, but it’s moving quickly into the mainstream.

Matt Damon, LeBron James and Larry David promoted cryptocurrency platforms in a series of Super Bowl ads, which were so popular that they caused one cryptocurrency app to crash after the game.

What’s more, the Staples Center in Los Angeles was recently renamed the Crypto.com Arena, after Crypto.com reportedly paid more than $700 million for the naming rights.

There’s a lot of hype surrounding cryptocurrency these days, but what exactly is it, and is it right for the average consumer or investor?

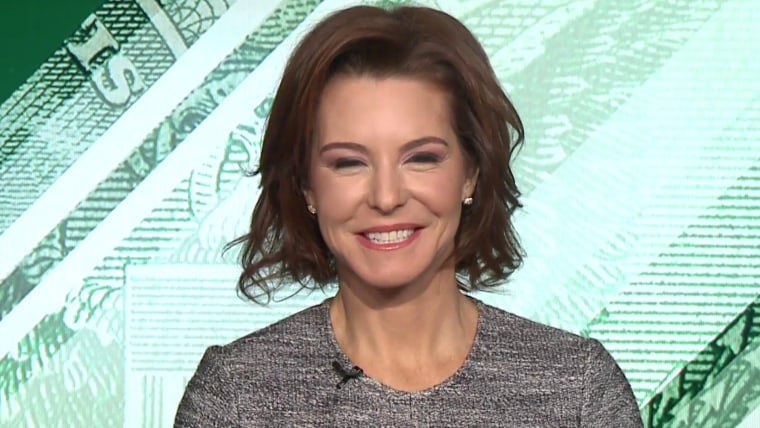

Reporting for TODAY, NBC’s senior consumer investigative correspondent Vicky Nguyen breaks down what cryptocurrency is, how to know whether it’s trustworthy, and red flags to be aware of before diving in.

What is cryptocurrency?

Cryptocurrency is a virtual currency that is stored on a kind of digital ledger called a blockchain.

Some cryptocurrencies can be used like money to purchase goods. Other cryptocurrencies are handled more like stocks that are traded, meaning their value can fluctuate.

There are more than 17,000 cryptocurrencies, but some of the most popular include Bitcoin, Ethereum, Tether, and Binance Coin. Cryptocurrencies are traded on digital platforms or exchanges, such as Coinbase, Gemini, and Crypto.com.

The “crypto” in the name refers to the fact that transaction details are encrypted on the blockchain, with cryptocurrency owners holding a digital “key” that proves that they own the currency.

What’s the point of cryptocurrency?

Why use cryptocurrency at all, as opposed to sticking with traditional money or stocks?

Some people like the fact that cryptocurrency is not regulated by a centralized government or agency. Rather, the virtual currency is stored securely on digital blockchains, which are hosted by a decentralized network of computers around the world.

Many people believe this gives cryptocurrency owners more security, privacy and autonomy.

Other proponents of cryptocurrency are interested in the potential future applications of the blockchain, the digital network where cryptocurrency is stored.

For example, the blockchain could serve as a network for transmitting different kinds of information, according to the accounting firm PricewaterhouseCoopers — such as sharing patients’ healthcare information securely, or even gathering votes in an election.

How to buy trustworthy cryptocurrency

If you’re interested in buying cryptocurrency, stick to credible platforms like Coinbase or Binance. The website CoinMarketCap lists established cryptocurrencies, as well as industry news, so you can do your research before buying.

Be wary if someone tries to solicit crypto payments from you online, especially on social media.

Transactions made with cryptocurrency are not reversible, so it’s crucial to be alert to potential fraud and scammers.

This week, President Biden is expected to issue an executive order that will task government agencies with investigating the risks of trading in cryptocurrencies.

What you should be aware of before investing?

Investing in cryptocurrency is a risk for several reasons. First, the value of cryptocurrencies, like traditional stocks, can fluctuate dramatically.

“You have to be prepared for wild volatility,” Mike Bisaro, president and CEO of StraightLine Financial, told Nguyen.

Also “there is virtually no regulation about any of these players or about the industry in general,” Bisaro said. “You have to, I believe, look at it as more or less speculation.”

The IRS now also requires you to report any financial gains from cryptocurrency investments on your taxes, so make sure your crypto exchange platform allows you to access your tax documents.

In short, while cryptocurrency can present some interesting opportunities, investing in this kind of digital asset should not be viewed as a get-rich-quick scheme.

“The slow, diversified approach really does tend to win,” Bisaro said. “It just doesn’t tend to make for real exciting headlines and real good Super Bowl commercials.”